Of the five sectors expected to see a meaningful impact, gems and jewellery has the highest exposure to the US at around $10 billion.

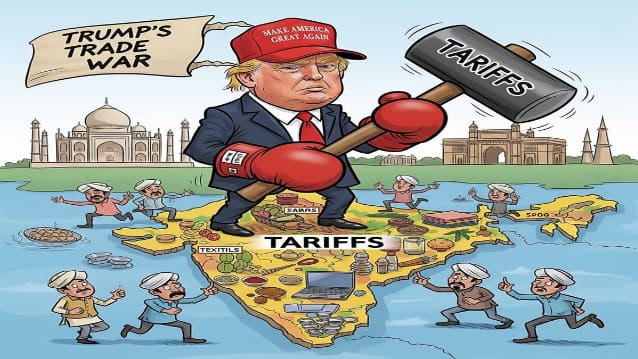

The impact is likely to be marginally unfavourable for auto components sector as the US accounts for only 3.5 per cent of India's total production. (Source: AI Image)

The 25 per cent tariff imposed by the US, which will take effect from August 27, in addition to the existing 25 per cent, will significantly impact Indian MSMEs. According to a Crisil report on Wednesday, the maximum impact is likely to be borne by textiles, gems and jewellery and seafood industries, which account for around 25 per cent of India’s total exports to the US.

Importantly, MSMEs have more than 70 per cent share in these sectors and will be hit hard, Crisil noted. Another sector likely to face the heat is chemicals, where MSMEs have a 40 per cent share.

Crisil’s Director Pushan Sharma believes the partial absorption of the increased product prices due to higher tariffs will put pressure on MSMEs and will squeeze their already-slim margins, posing a material challenge to their competitiveness.

Also read: Indian Pharma Faces Growing Risk of US Tariffs, Fitch Warns

“For instance, those into readymade garments (RMG) are expected to lose ground in the US as the tariff increases to 61 per cent, including 50 per cent additional ad valorem duty, compared with peers in Bangladesh and Vietnam tariffed at 31 per cent. The Tirupur cluster, which accounts for over 30 per cent of India's RMG exports, will be severely impacted as around 30 per cent of its exports are to the US.”

Similarly, in the gems and jewellery sector, MSMEs in Surat, which dominates diamond exports with over 80 per cent share, will feel the tariff shock. As such, diamonds account for over half of the country’s gems and jewellery exports, and the US is a major consumer of Indian diamonds, comprising nearly a third of exports.

Crisil said seafood MSMEs will be disadvantaged following the imposition of a 50 per cent tariff, as they face severe competition from Ecuador, which is geographically closer to the US and has been levied a much lower tariff of 15 per cent.

The country sees significant competition in chemicals also from Japan and South Korea, which have lower tariffs.

However, the impact is likely to be marginally unfavourable for auto components sector as the US accounts for only 3.5 per cent of India's total production. Here, MSME suppliers, which provide components to larger players that export to the US, will be impacted.

The impact will be particularly pronounced for MSMEs supplying components for gearbox and transmission equipment, which account for a fourth of India's auto component exports and have a significant US exposure of around 40 per cent.

For the uninitiated, the increase in tariffs comes amid a challenging time faced by most of these sectors. For instance, RMG exports have recovered after declining 7 per cent on-year in fiscal 2024 and logged 13 per cent on-year growth in fiscal 2025, albeit on a low base.

Also, the gems and jewellery sector reported a 10 per cent-a-year decline over the past two fiscals on a compound annual growth rate basis.

Some sectors, however, remain unscathed for now, Crisil said. For instance, pharmaceutical products, which comprise a 12 per cent share in exports to the US, are currently exempt from tariffs.

In steel, the US tariffs are expected to have a negligible impact on MSMEs as these are engaged mainly in the re-rolling, producing long products, whereas the US primarily imports flat products from India. Also, the US accounts for only 1 per cent of India's steel exports.

Also read: NPA Levels in CGTMSE-Backed MSME Loans Hit Multi-Year Low in FY25 Across States

In the textiles, chemicals, seafood and auto components sectors, the US tariffs will affect $19 billion worth of exports, a part of which stands at risk. However, given that the domestic market for these sectors is expected to grow by $10 billion, the impact is expected to be mitigated to some extent.

According to Crisil, of the five sectors expected to see a meaningful impact, gems and jewellery has the highest exposure to the US at around $10 billion.

“While we expect export volumes to contract, the impact may not be fully reflected in revenue terms because of a likely runup in gold prices and sustained domestic demand,” it said.

To further mitigate the impact, Crisil said that India can increase exports to other countries as well as leverage the benefits of the recently concluded trade deal with the UK and a potential deal with the European Union.

Empower your business. Get practical tips, market insights, and growth strategies delivered to your inbox

By continuing you agree to our Privacy Policy & Terms & Conditions