A number of states now have FY25 NPA ratios that are less than one-third of FY21 levels.

The improved asset quality may allow banks and NBFCs to further expand collateral-free lending to smaller businesses. (Source: pixabay)

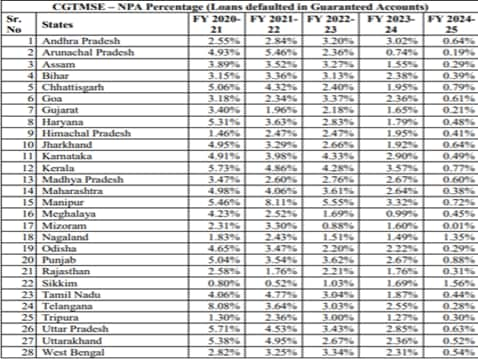

Collateral-free credit extended under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) has recorded a steady decline in NPA ratios in FY25, with all 28 states reporting lower NPA levels compared to the previous four years.

An analysis of the latest state-level CGTMSE data, shared by Shobha Karandlaje, Minister of State in the MSME Ministry in Rajya Sabha on Monday, showed that the trend is not restricted to a few large markets, but is visible across a majority of geographies including several North-Eastern and smaller states.

In Andhra Pradesh, for instance, the NPA ratio has dropped to 0.64% in FY25 from over 3% in FY23 and FY24. Similar declines are visible in Kerala (0.77% in FY25 versus 3.57% in FY24), Maharashtra (0.38% vs 2.64%), Karnataka (0.49% vs 2.90%) and Uttar Pradesh (0.63% vs 2.85%).

Also read: From 44% to 10%: The Shrinking Footprint of States on GeM Portal in 5 years

Source: MSME Ministry

Several weaker states, which had historically reported high default levels, have also shown a visible improvement. In Manipur, the NPA ratio dropped to 0.72% in FY25 from 3.32% in FY24 and 5.55% in FY23. Arunachal Pradesh has improved steadily to 0.19% in FY25 compared with 0.74% in FY24 and a high of 5.46% in FY22.

Importantly, the improvement is not a one-year statistical movement. A number of states now have FY25 NPA ratios that are less than one-third of FY21 levels. For example, Odisha has declined from 4.65% in FY21 to just 0.29% in FY25, while Haryana has fallen from 5.31% to 0.48% over the same period.

The steady improvement follows the better monitoring of MSME borrowers after the post-pandemic surge in credit demand, as well as the use of revised risk models which are helping identify vulnerable enterprises earlier in the credit lifecycle.

Also read: Nearly 1 Lakh MSMEs Shut Since FY21; Minister Jitan Ram Manjhi Cites Key Reasons

There is also greater scrutiny by CGTMSE on post-disbursement use of funds and a stricter claim settlement framework introduced after the scheme was expanded in FY23.

The improved asset quality may allow banks and NBFCs to further expand collateral-free lending to smaller businesses, a segment that has seen strong demand over the last two years, without materially increasing risk.

As per the data from the MSME Ministry, gross MSME NPAs in India had dropped to 3.59% as of March 31, 2025, from 11.03% in FY20.

Launched in 2020, the scheme provides guarantee cover up to 85% for loans amounting to Rs 10 crore or below, extended by eligible Member Lending Institution (MLIs) to micro and small enterprises (MSEs). As of July 31, 2025, CGTMSE has approved 1.22 crore number of cumulative guarantees worth Rs 10.50 lakh crore.

Empower your business. Get practical tips, market insights, and growth strategies delivered to your inbox

By continuing you agree to our Privacy Policy & Terms & Conditions